Apr 04, 2021 by

Why consider Dallas for real estate investing?

Dallas itself might not be the biggest housing market in the country, but when you lump in its neighboring towns of Fort Worth and Arlington, you get a massive metropolitan area home to more than 7.5 million people — rivaling only New York City in terms of population.

The area — known to most locals as “DFW” — is a sprawling, 8,600-square-mile stretch of culture, industry, and education. It’s home to some of the world’s biggest defense manufacturers, big-name players in oil and gas, and a number of top-notch universities and colleges, including Texas Christian University, Southern Methodist University, the University of North Texas, and more.

Are you considering investing in Dallas-area real estate? Here’s what you need to know about the 2021 market.

The state of the market

Dallas is in the process of bouncing back from the pandemic. Unfortunately, while many of its housing market indicators are improving, there are some key issues that could hold the city — as well as those who wish to invest there — back.

Here are the three major trends we’re seeing in the Dallas-Fort Worth area right now:

- Supply is a problem.

- Rentals aren’t in high demand.

- Prices are rising, both on rentals and single-family homes.

1. Supply is a problem. This sounds like a throwaway (after all, supply is an issue everywhere these days), but in DFW, it’s notably bad.

Not only is current housing supply at record lows, but it’s also below the national average. To make matters worse, there doesn’t seem to be much hope on the horizon. Building permits are down, builder confidence is waning, and construction is getting more expensive. The one bright spot is in multifamily, which has seen a major uptick in permitting activity over the last month.

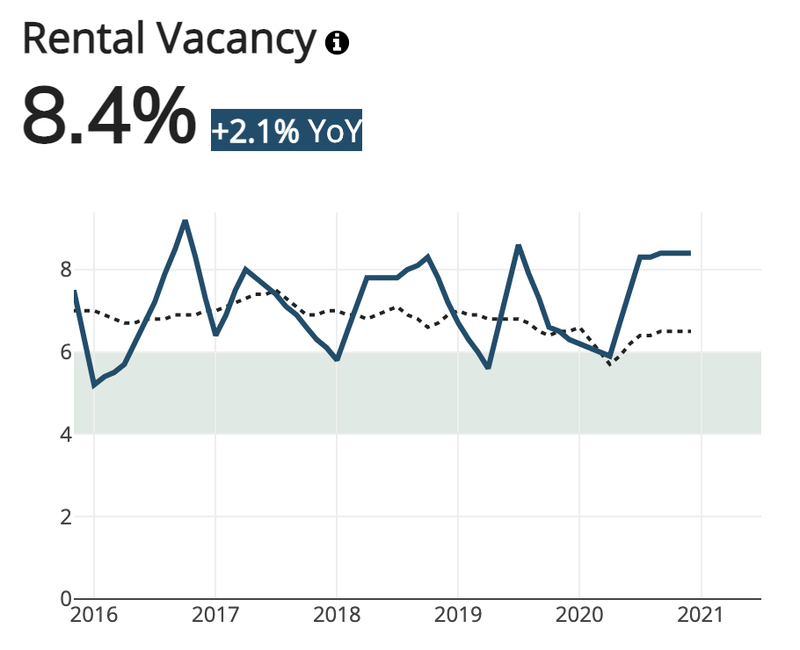

2. Rentals aren’t in high demand. Rental vacancies in Dallas have been all over the place: up, down, and then right back up again. But right now? They’re sitting high at 8.4%, well above national averages.

With more multifamily construction on the way (see above about multifamily permitting data), it makes you wonder: Who will live in all those added units?

3. Prices are rising — both on rentals and single-family homes. Like most of the country’s housing markets, rents and home prices are on the rise in Dallas. Homes are almost 12% more expensive than they were a year ago, and rents are just under 3% higher.

Both fall under the national trendline for now, but when compared to other Texas markets (save for Austin), they clock in among the most expensive. For investors, it’s reason for optimism — especially those eyeing rental properties (or anyone looking to sell a home in the near term).

Dallas housing demand indicators

Charts courtesy of Housing Tides, an EnergyLogic company.

Demand is likely to weaken in the Dallas area this year, as many of the region’s key indicators are trending downward. Though the area is adding a healthy number of households annually, consumer sentiment and employment are down. With rent and home prices on the rise, this could stifle demand in the months to come. Overall, our data shows the majority of Dallas’ demand indicators are “unhealthy” and “weakening.”

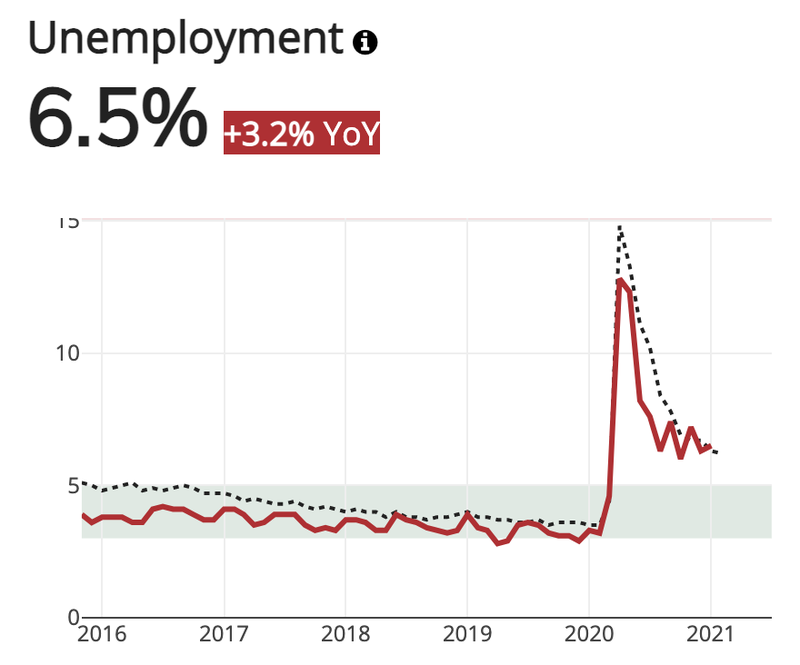

Unemployment trends

As with many cities in the U.S., unemployment is up in Dallas. The current unemployment rate in DFW is 6.5%, an improvement from the 12.8% rate seen almost a year ago but higher than the current national average of 6.3%.

The region has lost around 116,000 jobs in the last year. Job losses had been steadily shrinking between April and December, but they saw a slight increase in January. Despite this, they’re still a marked improvement over the 400,000 jobs lost last March.

Click to enlarge

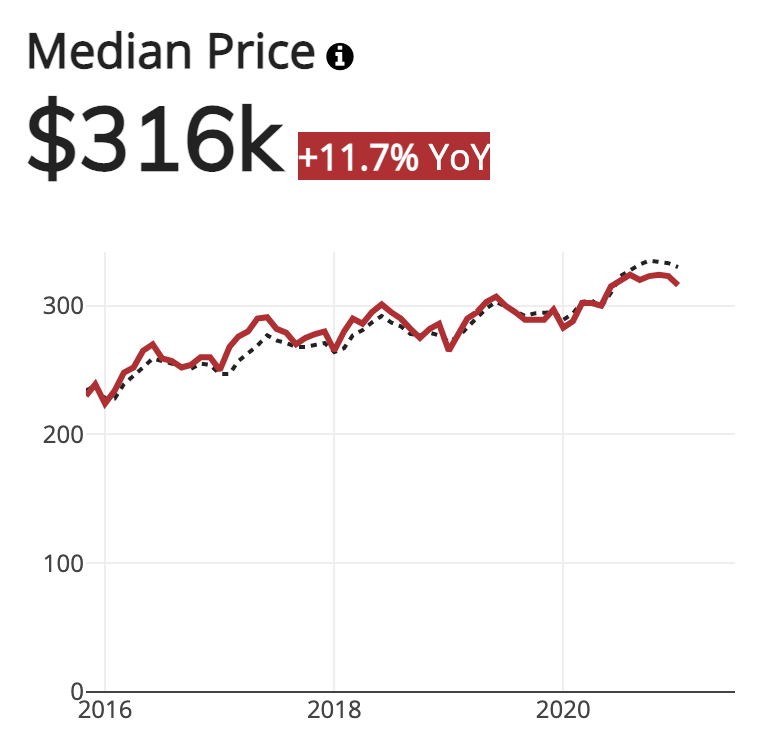

Median home price

Dallas’ median home prices have been on the rise for some time now. Prices have risen nearly 12% in the last year and currently clock in at $316,000. While that’s slightly below the national average of $330,000, it’s up a whopping $85,000 since just five years ago. It’s also on the higher end in terms of Texas markets. (Both Houston and San Antonio have median prices well below this number.)

A quick note here: The median price did drop in January, falling from the $323,000 seen in December and $324,000 in November. It’s too early to say if this is a reliable trend, though.

Click to enlarge

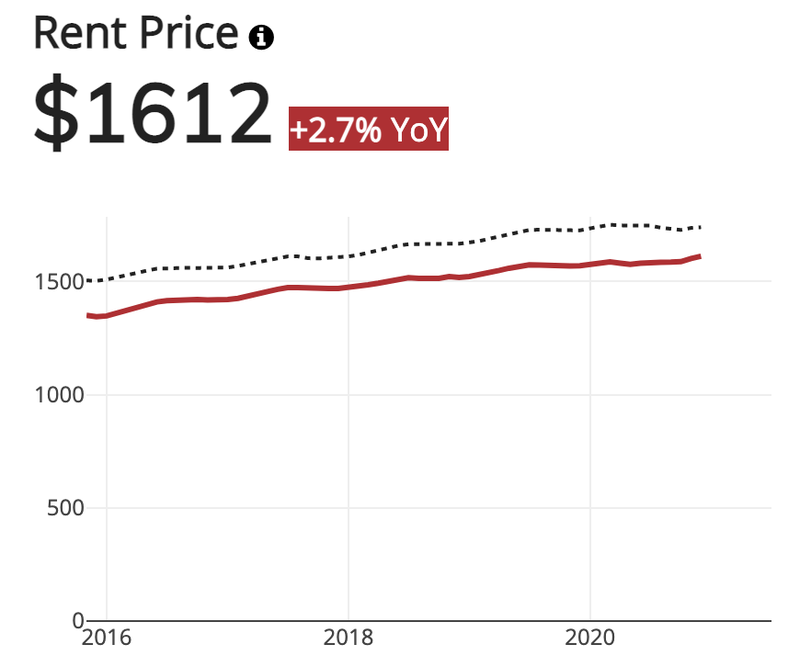

Median Rent Price

Rents in Dallas rose 2.7% over the last year, and the current median price sits at just over $1,600. It’s up about $30 since the start of the pandemic and over $250 from five years ago.

With that said, rents in Dallas are still much more affordable than the national average. The current U.S. median rent clocks in at $1,740.

Click to enlarge

Dallas housing supply indicators

Things aren’t looking too positive on the supply side of things either. Dallas’ housing supply is down considerably since 2019, rental vacancies are up, and builder sentiment is waning. When you throw in that construction costs are rising, and jobs in the sector are on the downslide, it doesn’t appear the market will get much help in the supply department anytime soon.

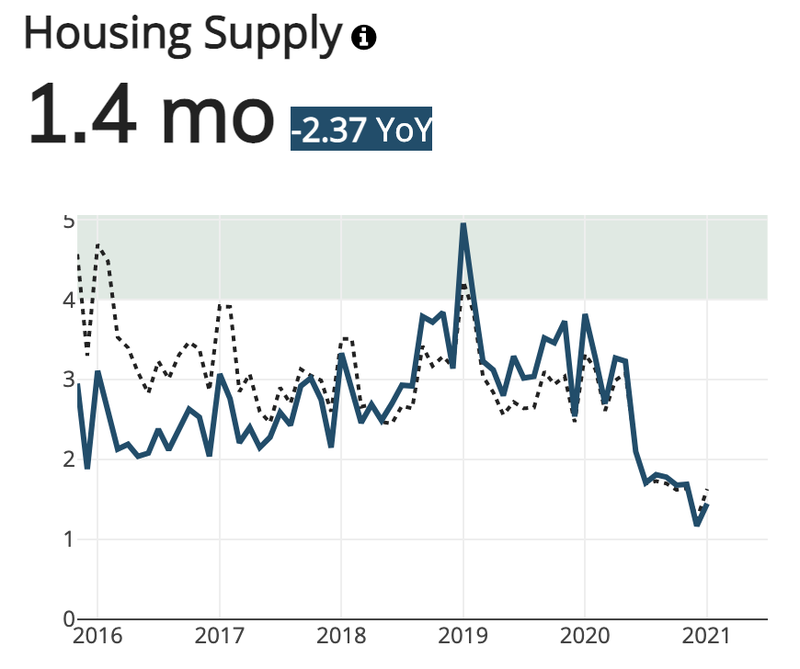

Total housing supply

As of February 2021, Dallas currently has a 1.45-month supply of available homes. That’s down from 3.27 months pre-pandemic and a decrease of 2.7% over the year. It’s also lower than the national average. As a whole, the U.S. currently has a 1.63-month supply of inventory.

Click to enlarge

Rental vacancies

Vacancies have seen a bumpy road in Dallas and are now at their third-highest point in the last five years. Currently, 8.4% of all rental properties are vacant, up from 6.1% before the pandemic. The rental vacancy rate is also higher than the national average, which clocks in at just 6.5%.

Click to enlarge

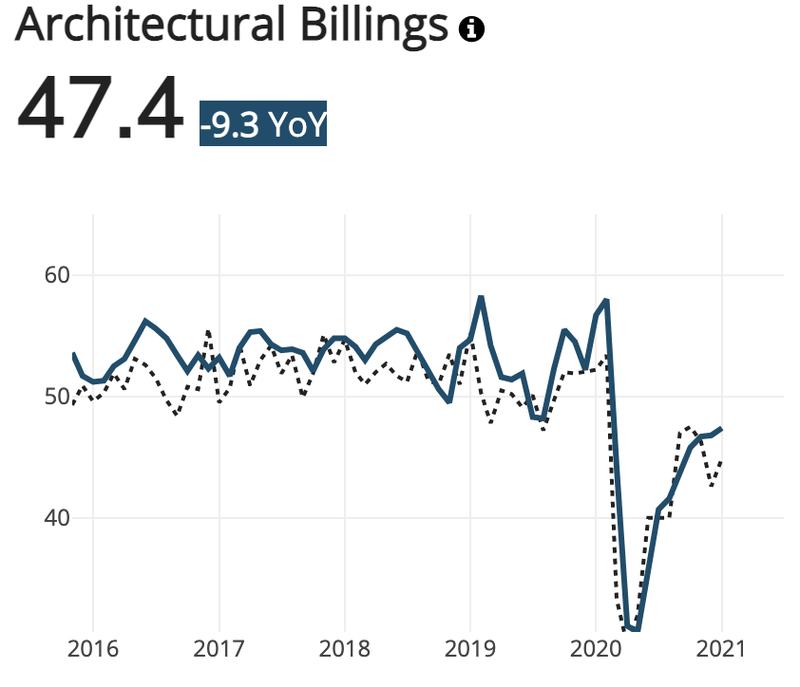

Architectural billings

Architectural billings are measured regionally and are typically a strong indicator of future non-residential construction activity, and unfortunately, those are down more than 9% year over year in the South.

There is a silver lining, though: Billings have increased steadily since the middle of last year. They’re also up over national averages, which could indicate improving construction, at least regionally (not necessarily Dallas specifically).

Click to enlarge

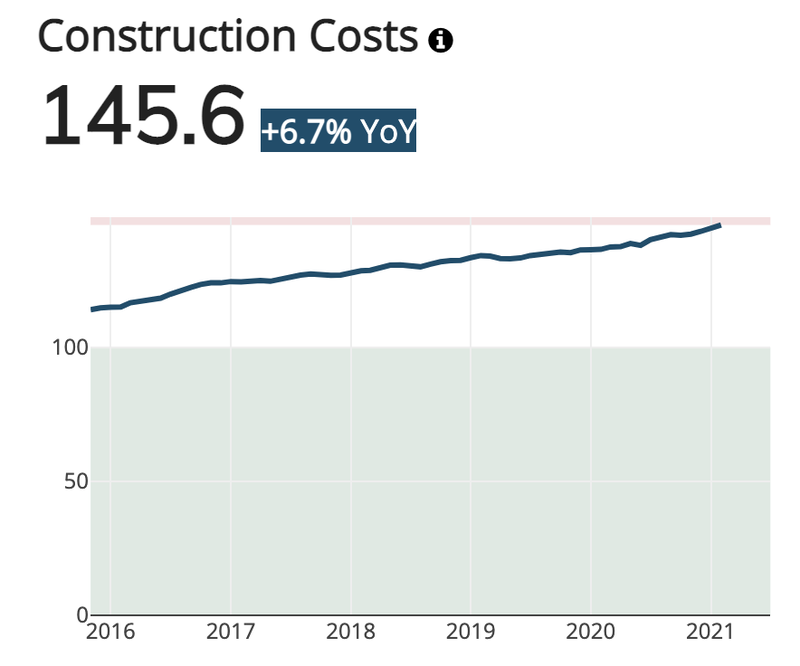

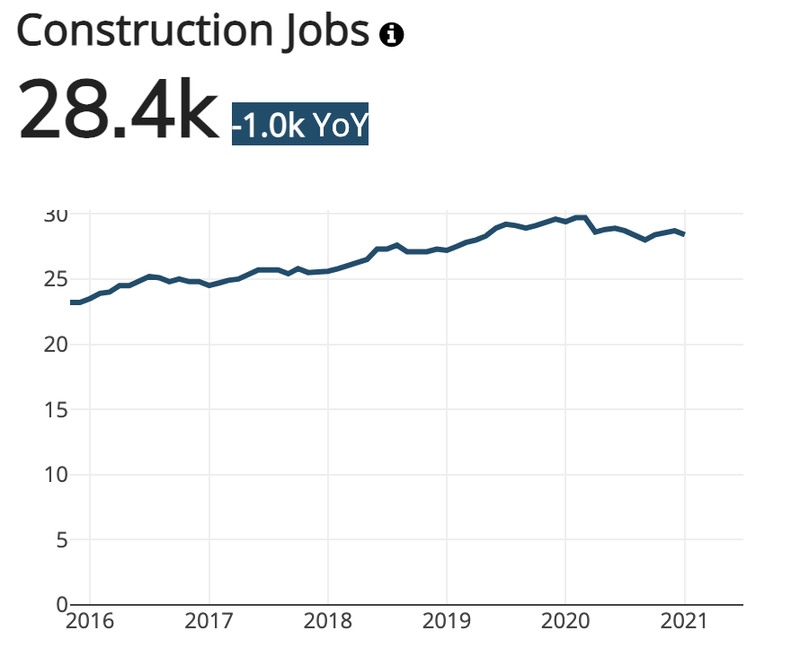

Construction indicators

Builders in the Dallas area face strong headwinds, as construction costs have risen 6.7% in just the last year. They’ve been on a steady incline since at least 2016, but recent spikes in lumber prices have compounded the issue. According to the National Association of Home Builders, lumber prices have jumped about 200% over the year and are now adding around $24,000 to the cost of each new property.

There’s a labor shortage, too. The Dallas construction industry lost about 1,000 jobs in the last year.

Click to enlarge

Click to enlarge

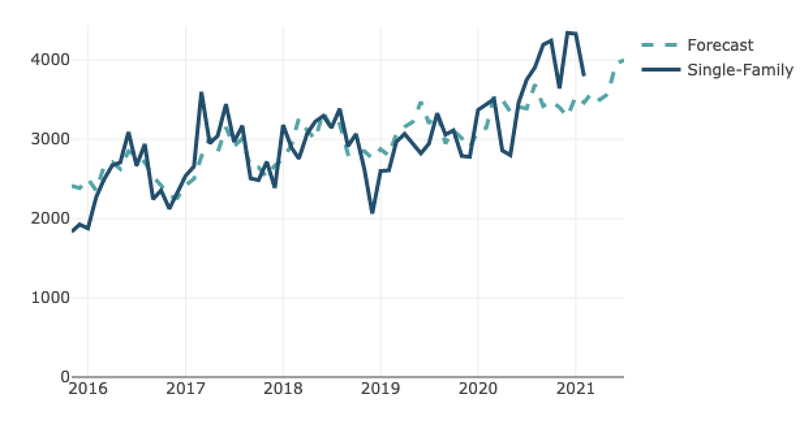

Single-family permits

Single-family construction permits dropped steeply at the start of the year, falling by about 550 permits between January and February alone. It’s the second dip these permits have seen in the last six months.

Fortunately, permits are up from their pandemic trough, and forecasts have them increasing in the near term. Waning builder sentiment, however, could put a damper on that.

Click to enlarge

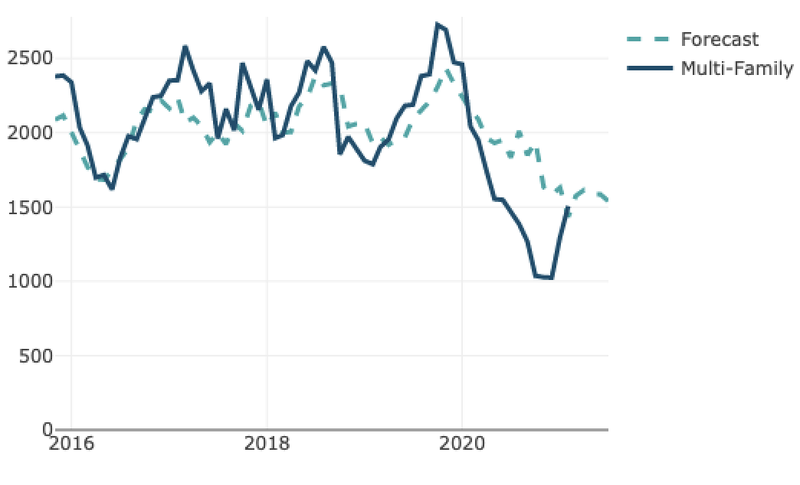

Multi-unit permits

Dallas’ multifamily permits bottomed out at the end of 2020 but have been trending upward ever since. About 1,500 permits were issued in February, slightly higher than forecasted.

There’s still a long way to go until they hit pre-pandemic numbers, though. Back in late 2020, more than 2,700 permits were issued.

Click to enlarge

Dallas real estate financial health indicators

With unemployment up in the area, many Dallas homeowners and renters are struggling. But thanks to the various COVID-related foreclosure bans in place, as well as widespread mortgage forbearance options, many have avoided delinquency or foreclosure so far. Once those measures expire, however, the data could tell a different story.

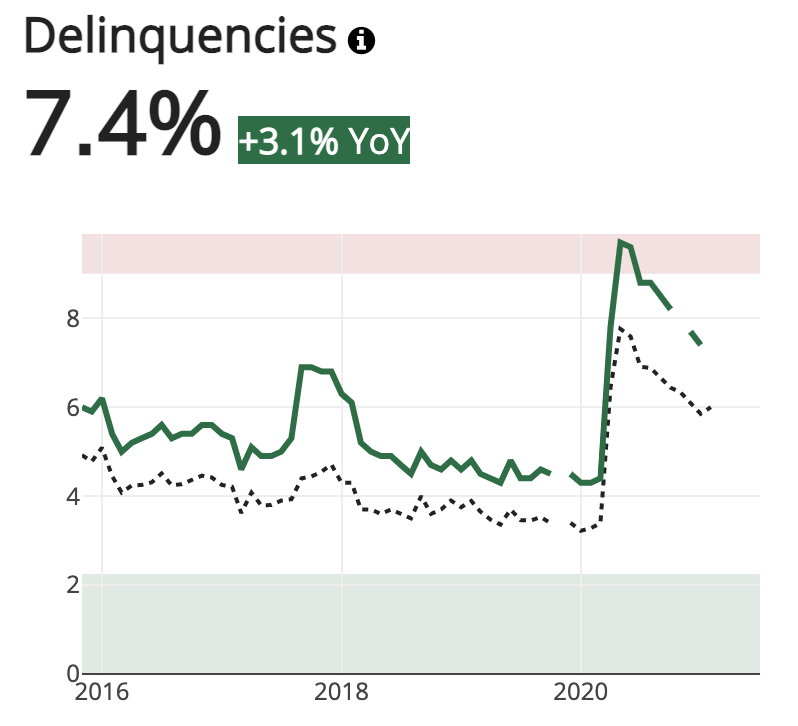

Delinquencies

Mortgage delinquencies, which are measured by state, are up 3.1% over the year, with 7.4% of all mortgages in some stage of delinquency. That’s well above the national average, which currently clocks in at 5.85% of all loans.

Click to enlarge

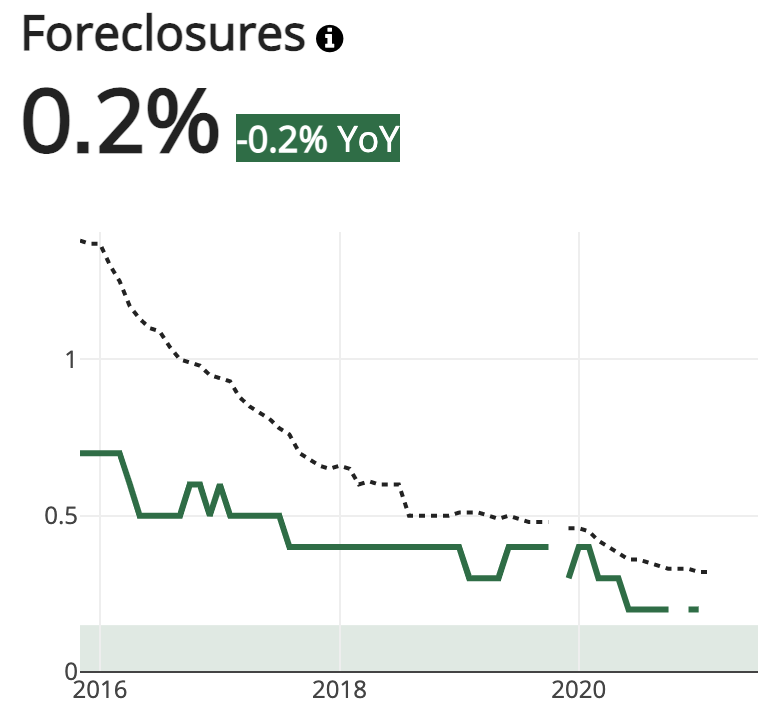

Foreclosures

Thanks to foreclosure moratoriums, foreclosures are actually down 0.2% annually, despite all the economic hardship many households are facing. That number’s down from the 0.7% foreclosure rate seen in 2015 and below the national average of 0.32%. About 0.2% of all Texas homeowners are in foreclosure.

Click to enlarge

Anchor institutions

Dallas is home to 42 Fortune 1000 companies, with many located in Irving — a suburb on the Northwest side of town. Downtown Dallas, Plano, and Grapevine are also home to several major companies.

Here’s a look at some of the larger industries in the area:

- Transportation: American Airlines (NASDAQ: AAL) is one of Dallas’ biggest employers, with more than 10,000 in its workforce across the region. Other transportation companies like Southwest Airlines (NYSE: LUV), BNSF Railway, and General Motors also have headquarters there.

- Technology: Technology is a big part of Dallas’ economy, with companies like Texas Instruments (NASDAQ: TXN), McAfee (NASDAQ: MCFE), Verizon Communications (NYSE: VZ), and more.

- Finance: Dozens of financial giants call DFW home. At the top of the list are banks like JP Morgan Chase (NYSE: JPM), Fidelity Investments, Capital One (NYSE: COF), Wells Fargo (NYSE: WFC), and Citigroup (NYSE: C). GM Financial (NYSE: GM) and BBVA also have posts there.

- Defense: You can’t talk about Dallas without mentioning its major defense players Lockheed Martin (NYSE: LMT), Haliburton (NYSE: HAL), and Raytheon (NYSE: RTX). Between the three of them, the companies employ more than 20,000 in the area.

- Healthcare: Dallas isn’t just home to major healthcare centers like Cook Children’s, Texas Health Resources, and Baylor Scott & White, but it also lays claim to various health insurers as well, including Aetna, Blue Cross Blue Shield, and Cigna.

Schools of note

The DFW metroplex is home to more than a dozen colleges and universities, as well as several community college systems.

Here are some of the biggest institutions in the Dallas-Fort Worth area:

- Southern Methodist University. At No. 66 on U.S. News and World Report’s list of top 2021 universities, SMU is the best-rated college in the region. It’s located in Dallas’ University Park area, just a few minutes from uptown, and has more than 12,000 undergraduate and graduate students.

- University of North Texas. Located in Denton on the northern end of the metroplex, UNT is a public university serving 41,000 students. Its music school is the biggest in the country and is one of the school’s most-honored programs.

- Texas Christian University. Ranked the No. 80 on U.S. News’ list, TCU is a bustling university known for its business program, its Rose Bowl-winning football team, and its newly launched medical school. It’s located in Fort Worth and claims just over 11,000 students.

- The University of Texas at Arlington/Dallas. The University of Texas — one of the most notable higher education institutions in the state — has campuses in both Arlington and Dallas. UTA has about 43,000 students, while UTD has 28,000.

The University of Dallas, Dallas Baptist University, Texas Wesleyan University, and Texas Woman’s University are also located in the Dallas-Fort Worth metroplex, as are community college systems like the Dallas County Community College District and Tarrant County College.

Neighborhoods of note

In such a massive metropolitan area, there are tons of areas to invest in real estate. The best spot will ultimately depend on your goal for the investment (e.g., rental, flip, vacation home, etc.) as well as your budget, but here are some of the top Dallas-specific neighborhoods you might want to consider:

- Uptown. Uptown is a true work-live-play neighborhood full of high-rises and rental units. There are major employers in the area, as well as plenty of restaurants, parks, and culture, too.

- University Park. If student housing is on your radar, University Park is the place to look. It’s home to the majority of off-campus SMU students, and hotspots like Mockingbird Station, Lower Greenville, and Knox-Henderson are just a few blocks away.

- Oak Cliff. Oak Cliff is a recently reinvigorated neighborhood that boasts dozens of small businesses, shops, restaurants, and more. It’s even home to its own arts district (Bishop Arts) and has been dubbed Dallas’ Brooklyn due to its popularity with younger, more offbeat residents.

- Oak Lawn. Oak Lawn is a bustling community full of restaurants, bars, and culture, and it’s highly renter-centric. It’s walkable, diverse, and incredibly close to other hot areas like uptown and Knox-Henderson.

- Lake Highlands. If you’re targeting single-family homes, Lake Highlands deserves a look. Located on the northeast side of town, the community boasts highly rated schools, historic properties, and a very family-friendly feel.

These are just some notable neighborhoods in Dallas proper. For more suburban investments, look to places like Plano, Frisco, McKinney, or Richardson. Over in Fort Worth, the Bellaire, Overton, and Bluebonnet Hills areas can be smart investments, especially if you’re interested in student housing.

Unfair Advantages: How Real Estate Became a Billionaire Factory

You probably know that real estate has long been the playground for the rich and well connected, and that according to recently published data it’s also been the best performing investment in modern history. And with a set of unfair advantages that are completely unheard of with other investments, it’s no surprise why.

But those barriers have come crashing down – and now it’s possible to build REAL wealth through real estate at a fraction of what it used to cost, meaning the unfair advantages are now available to individuals like you.